It’s another first for Facebook Inc.’s stock: a third digit. Already the fastest company ever to reach $250 billion (AED918 billion) in market value, the social network operator has jumped over $100 a share, capping a 476% rally since September 2012 for the third-best performance in the Standard & Poor’s 500 Index. “The big seminal event for Facebook was showing they could make significant money and turn themselves into a well-run company,” Tim Ghriskey, who helps oversee $1.5 billion as managing director and chief investment officer at Solaris Asset Management, said by phone. The firm owns Facebook shares. “They’ve seen strong growth in advertising spending and viewership.” Facebook climbed 2.5% to $102.19 at 4 p.m. in New York on Friday. It breached the $100 level on a day when technology stocks surged the most since Aug. 26, as Microsoft Corp., Google parent Alphabet Inc. and Amazon.com Inc. added more than $80 billion in combined market value after quarterly profit topped estimates. This isn’t Facebook’s first flirtation with the $100 level. On July 21, the stock came within 1.7% of breaking it. It then became mired in the August stock market selloff, dropping 14% over three days to a two-month low. Since then it’s shown resilience, rallying back 24%. Facebook joins 109 other members of the benchmark index in the three-digit club amid speculation that the company will continue to increase mobile-advertising sales on its application and others. Its ascent comes at a time when stock splits are increasingly rare in an American stock market that is dominated by institutional investors and exchange-traded funds that don’t care about the absolute price of a share. As Facebook’s stock has increased, so has the net wealth of its founder and chief executive officer, Mark Zuckerberg. His fortune has risen $9.1 billion in 2015, the second-biggest increase for U.S. billionaires behind Amazon founder Jeff Bezos, according to the Bloomberg Billionaires Index. Zuckerberg is the the world’s eighth-richest person with $43.6 billion. Along with Apple Inc., Microsoft, Amazon and Google, Facebook is one of a quintet of technology giants that together make up almost 10% of the S&P 500 and more than a third of the Nasdaq 100. It’s the world’s seventh largest company, surpassing old economy stalwarts such as JPMorgan Chase & Co. and Johnson & Johnson. Technology stocks have been by far the biggest contributors to S&P 500’s recovery from a 10-month low, rising 18% since the market bottomed on Aug. 25. “Facebook has really established itself as a force,” Ghriskey said. “Reaching this level is a testament to the job management has done and the dominant product it is.” (By Joseph Ciolli/Bloomberg)

Air Arabia expands RAK network with Moscow route

Air Arabia expands RAK network with Moscow route

UAE holds 30% of Middle Eastern cinema market share

UAE holds 30% of Middle Eastern cinema market share

Vietnam says Musk's SpaceX plans $1.5b Starlink investment

Vietnam says Musk's SpaceX plans $1.5b Starlink investment

UAE, New Zealand conclude CEPA negotiations

UAE, New Zealand conclude CEPA negotiations

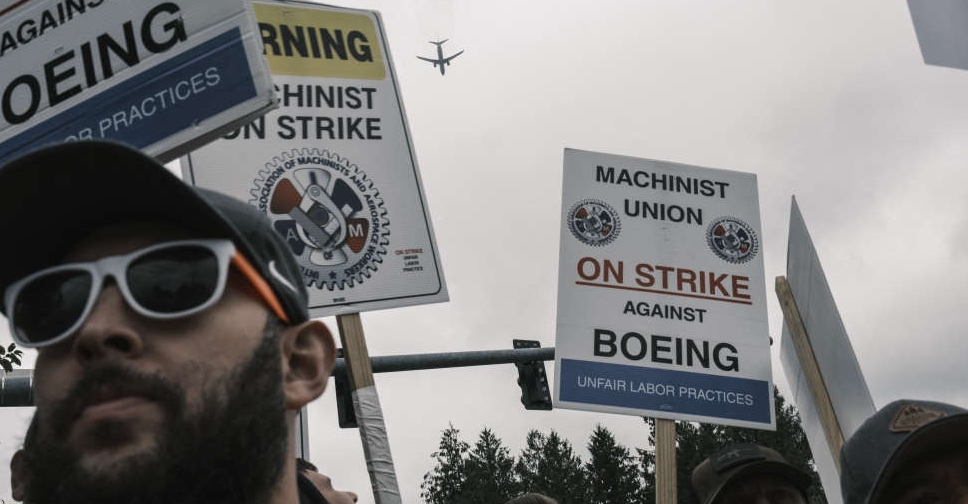

Boeing, striking union to resume contract talks on Friday

Boeing, striking union to resume contract talks on Friday