The UAE has announced plans to implement a minimum top-up tax of 15% on large multinational companies operating in the country, following amendments to certain provisions of the Corporate Tax Law.

This will be effective for financial years starting on or after January 1, 2025.

According to the Ministry of Finance, the Domestic Minimum To-Up Tax (DMTT) will apply to multinational enterprises with consolidated global revenue of 750 million euros ($793.50 million) or more in at least two out of the four financial years preceding the financial year in which the tax comes into effect.

The DMTT comes under the Organisation for Economic Co-operation and Development’s (OECD) two-pillar solution, aimed at establishing a fair and transparent tax system. It stipulates that large multinational firms pay a minimum effective tax rate of 15% on profits in each country where they operate.

The UAE's finance ministry also said it is considering introducing a number of corporate tax incentives, including one for research and development (R&D) that would apply for tax periods starting in 2026.

The expenditure-based incentive would offer a potential 30%-50% refundable tax credit depending on the size of the company's operations in the UAE and revenue, the ministry added.

Another incentive being considered is a refundable tax credit for high-value employment activities, which aims to encourage businesses to engage in activities that deliver significant economic benefits, stimulate innovation, and enhance the UAE’s global competitiveness.

It could be applied as early as January 1, 2025, and will be granted as a percentage of eligible salary costs for employees engaged in high-value employment activities.

This includes C-suite executives and other senior personnel performing core business functions that add substantial value to the UAE economy.

The final form and implementation of these proposed incentives, are subject to legislative approvals.

The ministry will provide further details and guidance for taxpayers regarding these incentives in due course.

The #MoFUAE has announced updates in relation to certain provisions of Federal Decree-Law No47 of 2022 on the Taxation of Corporations and Businesses aiming to enhance the business environment in the UAE and promote greater compliance with global standards for tax transparency pic.twitter.com/aX02JN8msT

— وزارة المالية | الإمارات (@MOFUAE) December 9, 2024

Bitcoin up by a fifth after Trump lists reserve tokens

Bitcoin up by a fifth after Trump lists reserve tokens

China preparing countermeasures to US tariff threat

China preparing countermeasures to US tariff threat

Dubai Holding, RTA sign AED 6 billion deal to enhance infrastructure

Dubai Holding, RTA sign AED 6 billion deal to enhance infrastructure

Dubai's energy demand rises 5.4% in 2024

Dubai's energy demand rises 5.4% in 2024

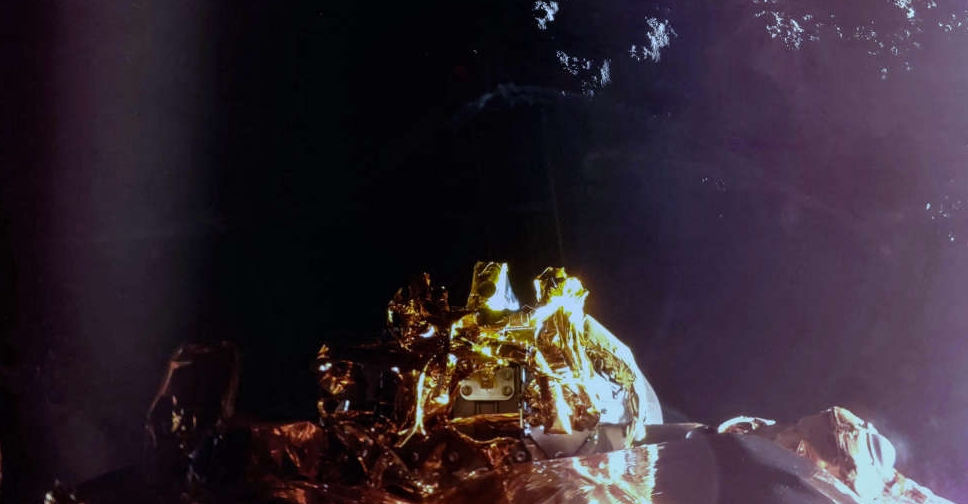

US firm Firefly scores its first moon landing

US firm Firefly scores its first moon landing